kansas sales and use tax exemption form

Not all states allow all exemptions listed on this form. This page discusses various sales tax exemptions in Kansas.

Burghart is a graduate of the University of Kansas.

. Wholesalers and buyers from other states not registered in Kansas should use. Ov for additional information. For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates located at.

The purchaser is responsible for ensuring it is eligible for the exemption in the state it. KANSAS SALES AND USE TAX ENTITY EXEMPTION CERTIFICATE Form PR-78D The Kansas Department of Revenue provides a complete package with all forms related to certifying that a purchase is exempt from sales and use tax. Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate.

Email Address The email address you used when registering. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kansas sales tax. The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any purpose that is not exempt from the tax the tax exempt entity is liable for the state and local sales or use tax.

If you are accessing our site for the first time select the Register Now button below. The buyer completes and furnishes the exemption certificate and the seller keeps the certificate on file with other sales tax records. Street RR or P.

Step 1 Begin by downloading the Kansas Resale Exemption Certificate Form ST-28A. The contents should not be used. Password Passwords are case sensitive.

Kansas Sales Use Tax for the Agricultural Industry at. In Kansas certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. It is designed for informational purposes only.

The Kansas Retailers Sales Tax was enacted in 1937 at the rate of 2 increasing over the years to the current state rate of 650. The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any. Your Kansas Tax Registration Number 000-0000000000-00.

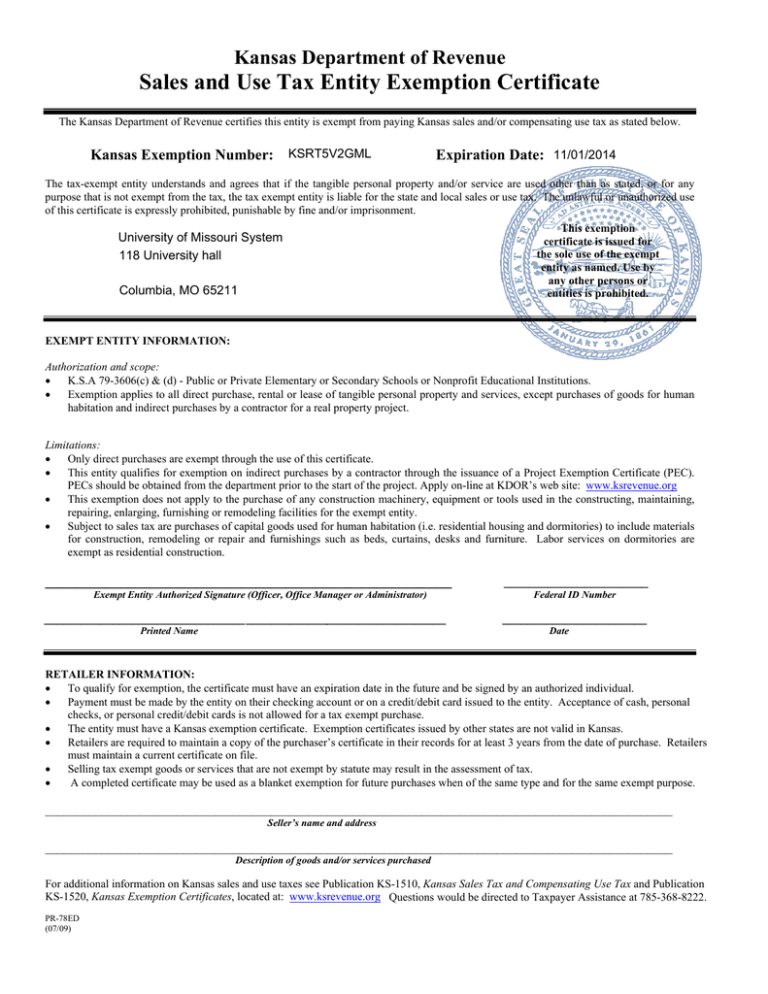

You can find resale certificates for other states here. Sales Tax Exemption for construction remodel equipment and furnishings Tax Exemptions via Industrial Revenue Bonds Utilities Consumed in Production Exemption Vehicle and Aircraft Exemption Certificate Waste Heat Utilization System Exemption Warehouse Machinery and Equipment Exemption Property Tax. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below.

Secretary Burghart has more than 35 years of experience combined between private and public service in tax law. An exemption certificate is a document that a buyer presents to a retailer to claim exemption from Kansas sales or use tax. Benefit from the online library of 85000 state-specific forms and form packages that you can edit and eSign online.

All construction materials and prescription drugs. Ad New State Sales Tax Registration. This document discusses the sample form PR-78D which is provided on page 16 of this packet.

Kansas sales and use tax exemption form Monday June 13 2022 The certificate is to be presented by tax exempt entities to retailers to purchase goods andor services tax exempt from sales and use tax. Ad Register and Edit Fill Sign Now your KS ST-28A Form more fillable forms. Kansas Sales Tax Exemption Certificate information registration support.

ST-28F Agricultural Exemption Certificate Rev 12-21 Author. Box City State Zip 4 _____ is exempt from Kansas sales and compensating use tax for the following reason. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or services purchased from.

Order for the sale to be exempt. Wholesalers and buyers from other states not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate Form ST-28M to purchase their inventory. The unlawful or unauthorized use of this certificate is expressly prohibited punishable.

Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify. For additional in formation see Publication KS-1520 Kansas Exemption Certificates. Provide their Kansas sales tax registration number on this form may use it to purchase inventory without tax.

US Legal Forms has been providing legal forms and form packages to consumers small businesses and attorneys for almost 25. Kansas Application for Sales Tax Exemption Certificates KS-1528 Kansas Exemption Booklet KS-1520 This publication assists businesses to properly use Kansas Sales and Compensating Use Tax exemption certificates. Sales Tax Exemptions in Kansas.

He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984. The certificates will need to be renewed on the departments website. If you want to.

HOWEVER if the inventory item purchased by an out-of-state retailer who has sales tax nexus with Kansas is drop shipped to a Kansas location the out-of-state retailer must provide. On November 1 2014 the sales tax exemption certificate issued by the Kansas Department of Revenue will expire. 200 1937 400 1986 530 2002 650 2015.

Kansas sales and use tax exemption form Saturday May 21 2022 92-20-18 exempt the sale of rolling stock including buses and trailers repair or. The renewal process will be available after June 16th. KANSAS SALES TAX Kansas is one of 45 states plus the District of Columbia that levy a sales and the companion compensating use tax.

Printable Kansas Exemption Certificates We have four Kansas sales tax exemption forms available for you to print or save as a PDF file. Send the completed form to the seller and keep a copy for your records. Do not send this form to the Streamlined Sales Tax Governing Board.

Is exempt from Kansas sales and compensating use tax for the following reason. For a Kansas sales tax exemption certificate to be provided to vendors for University purchases or for information regarding the Universitys sales tax exemption status in other states please contact KSU General Accounting office at 785 532-6202. Provide their Kansas sales tax registration number on this form may use it to purchase inventory without tax.

Thank you for using Kansas Department of Revenue Customer Service Center to manage your Department of Revenue accounts. While the Kansas sales tax of 65 applies to most transactions there are certain items that may be exempt from taxation. It shows why sales tax was not charged on a retail sale of goods or taxable services.

This is a multi-state form for use in the states listed. For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates. You may use the State of Kansas exemption certificate exclusively-that is an agency decision.

Ad Register and Subscribe Now to work on KS Exemption Certificates more fillable forms. US Legal Forms fulfills the needs of Kansas Mobile Homes Furniture Wholesale better than the competition. You can download a PDF of the Kansas Streamlined Sales Tax Certificate of Exemption Form SST on this page.

If any of these links are broken or you cant find the form you need please let us know. For other Kansas sales tax exemption certificates go here.

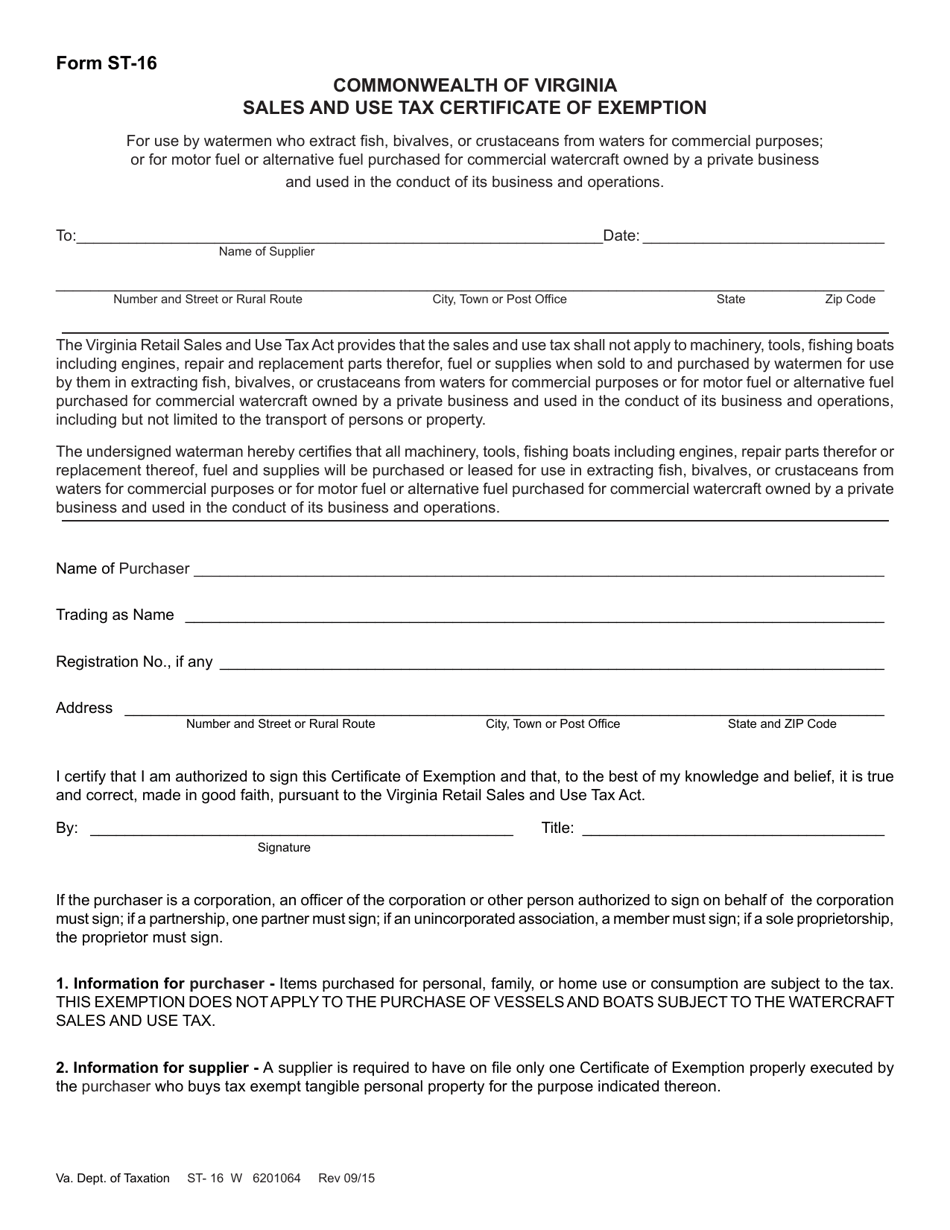

Form St 16 Download Fillable Pdf Or Fill Online Sales And Use Tax Certificate Of Exemption Virginia Templateroller

Pin On Fillable Department Of Motor Vehicles Dmv Forms

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

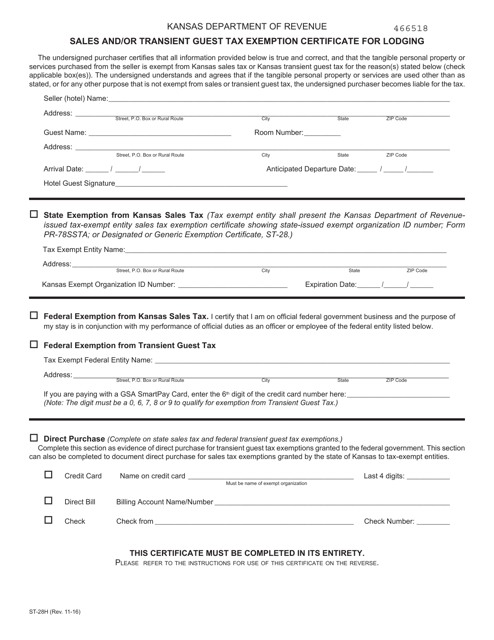

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller

Kansas Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

What Is A Homestead Exemption Protecting The Value Of Your Home Homesteading What Is Homestead Property Tax

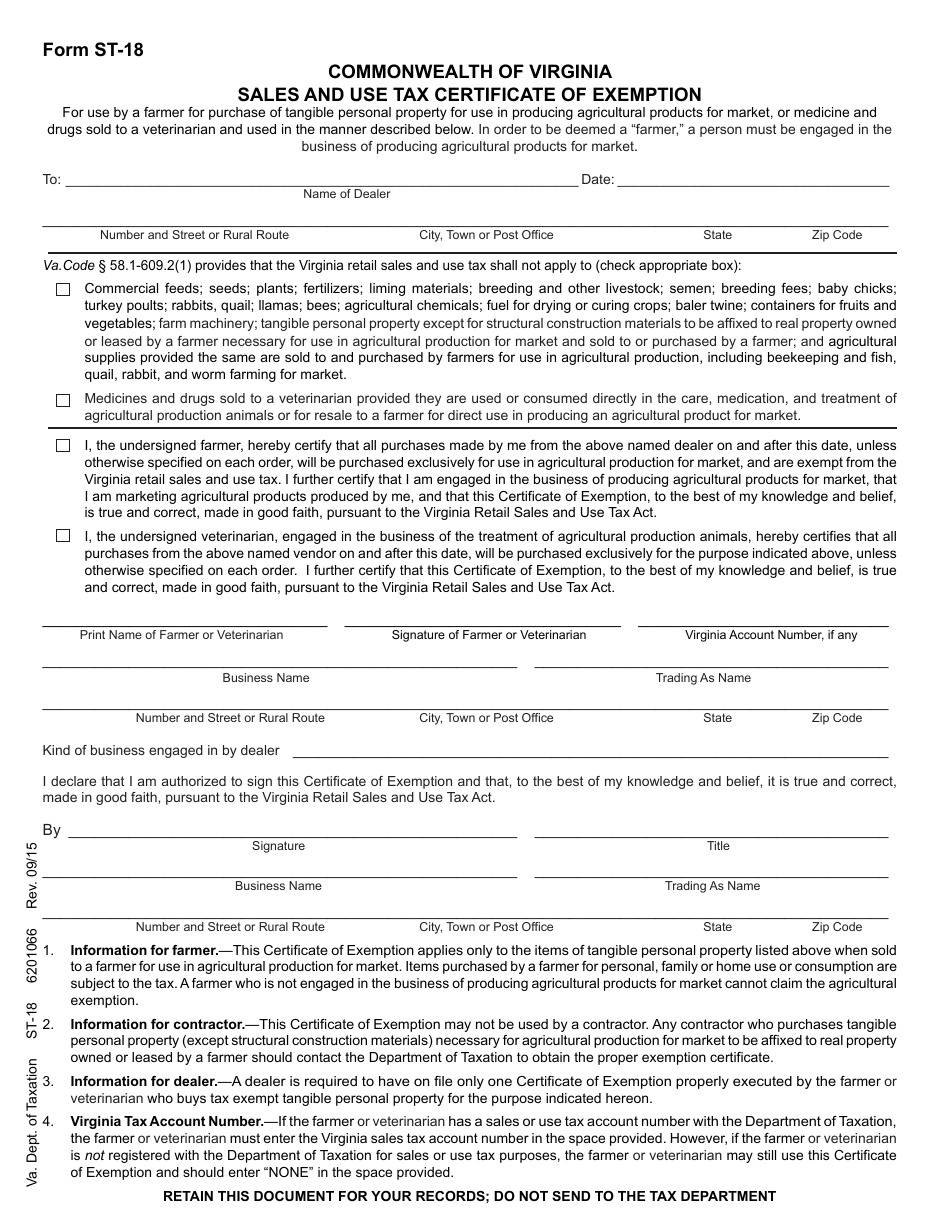

Form St 18 Download Fillable Pdf Or Fill Online Sales And Use Tax Certificate Of Exemption Virginia Templateroller

Sales And Use Tax Entity Exemption Certificate Kansas Department Of Revenue

Kansas Resale Exemption Certificate Fill Online Printable Fillable Blank Pdffiller